As I continue my journey into the world of Middle Market Private Equity it struck me that the skills to be successful are a blend of Corporate Executive skills and those of a Startup Founder. By blending the two worlds the Private Equity Executive is set up to have a tool kit to achieve the desired growth.

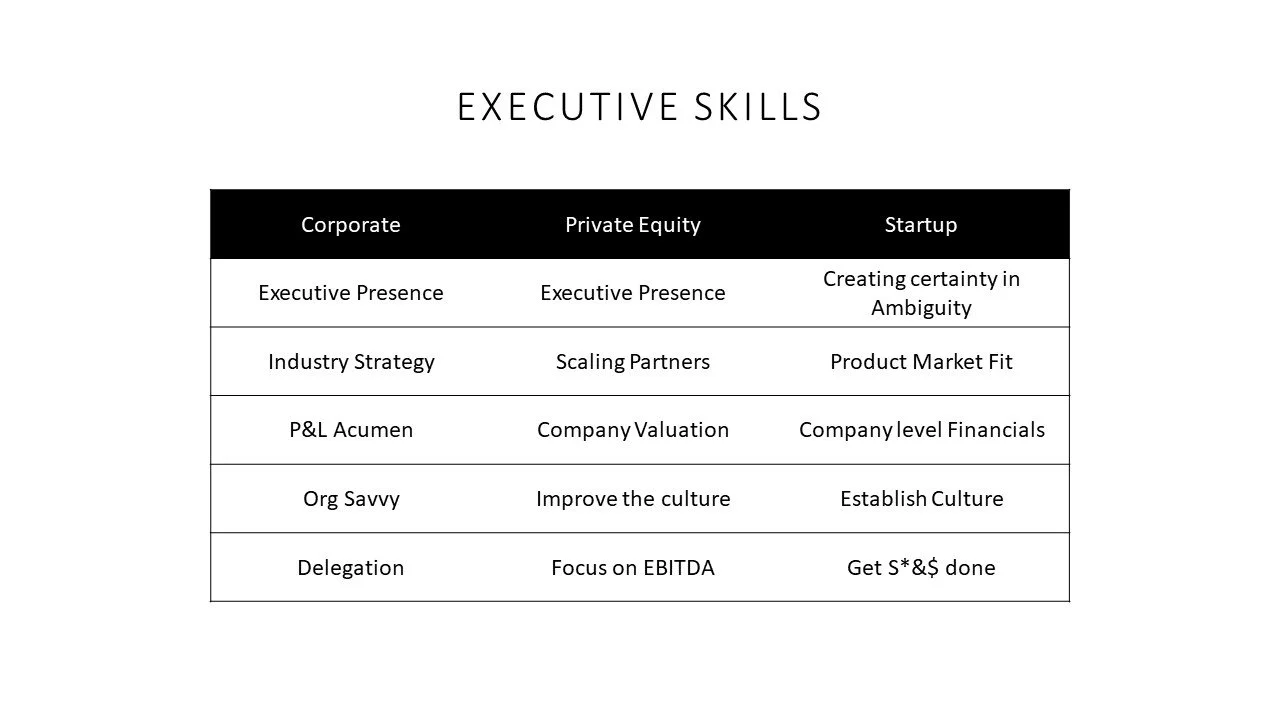

Let’s start with Corporate Executive roles. In this type of position you are regularly representing the company outside in the industry. This could be meeting with customers, ecosystem partners or suppliers. When you set growth strategies you typically have an impact on the industry you operate within. You may run a P&L and focus on key metrics like Revenue growth, Gross Margin and Operating Income. The corporate functions cover the balance sheet side of things so there is no worry about working capital or cash flow. Many times to get a decision made it means collaborating across departments in the company so building a set of “organizational savvy” skills to influence and persuade peers to support your strategy are critical. Lastly, you lead a large team so delegation is key to your success. Your time should be spent on growing leaders in your organization and coaching them versus doing the work yourself.

Critical skills in Private Equity are a hybrid of Corp and Startup Roles

On the other end of the spectrum are Founder/C-Suite roles in startups. The top critical skill is being able to take the highly ambiguous environment and create a certain path or task list for the organization. Many leaders new to startup roles find that the level of ambiguity drives anxiety and stress for them and its not a fit for them. The second most critical skill in startups is the ability to test and iterate to find product market fit. The most common failure of startups is an over focus on the product/solution and not enough innovation/testing on the business model to ensure scale and long term success. When reviewing the financials in a startup you are looking at company level financials including the balance sheet and statement of cash flows. There is a constant focus on cash burn and runway as taking the eye off the ball here can be perilous. In a startup you define the company culture- either in a purposeful manner or by de facto standard. This tone sets how the work is going to be done, how hires are made and what motivates employees to go the extra mile. Lastly in a startup you need to be able to both be strategic but also get S*&$ done. On a daily basis you are progressing the business model but also emptying the trash, depositing checks, and following up on every sales lead. The teams are small and there is simply too much work at hand to count on only delegating the work.

In the Private Equity world the role is a blend of these two ends of the spectrum. You still need executive presence as you are regularly representing the company with lenders, customers and PE backers. As you grow the company you need to find the key scaling partners and work with them to achieve the desired growth targets. The point of a PE backed company is Exit- which typically has a pretty definite timeline. As such there is a regular focus on building company value with every investment/project decision. Middle market PE firms are large enough to already have established company cultures. The key for the operating partner is to come in and find where that culture needs a tweak to be even more effective. Think of this as the 15% that needs to improve to get 3x the value. Lastly, the mantra in PE owned firms is EBIDTA growth. The teams are likely nimble and fast at decision making with the organizational structure being much flatter than corporate roles. The CEO will be more hands on as there just is not a large team to delegate to.

Do you agree these are the key skills? Did I miss any? Let me know what you think!